17125 Boones Ferry Rd.

Lake Oswego, OR 97035

Commonly called the BRRR Method, Northwest Private Lending’s Rehab & Refinance program allows the borrower to purchase distressed properties, make improvements, and ultimately refinance after finding tenants for rentals. We offer up to 80% of the borrowers’ purchase price. Once you have fixed up the property and have it rented out, we can work with you to get a long-term, low rate 30-year fixed mortgage.

Loan Origination Fee: 3 Points (min. $2,500)

Loan Document Fee: $650-850

Monthly Interest Rate: 1% per month

Monthly Payment: Interest Only

Loan Amount Range: $50,000 up to $2,000,000

Closing Costs: Paid by Borrower

Loan Closing: 3-5 Business Days

Loan Maturity: 1 month to 10 years

Property Appraisal: Not Required

Underwriting Fee: None

Pre-Payment Penalty: Never

Extension Fee: $0 on performing loans

Most of us would agree that investing in real estate is a great way to build wealth and create monthly cashflow…but have you ever wondered how professional real estate investors are able to purchase those “cash only” listings or take advantage of bank or tax foreclosure sales? How do they buy properties with built-in equity and create even more equity by fixing the property up? How do they utilize renters to pay off their loan in the long run? How do get money back out of the house so they can buy a 2nd, 3rd, or 10th investment property? Commonly referred to as the BRRRR Method, Northwest Private Lending specializes in helping clients Buy, Rehab, Rent, Refinance, and Repeat this process to build consistent income and wealth in real estate investment. To learn more about how to take advantage of our BRRRR loans click the video.

Location: 45 E. Collins Street, Depoe Bay OR

Property Value: $350,000

Loan Amount: $125,000

Scenario: The owner purchased the property for $170K cash. The property was in very bad shape and was getting $550 per month per unit. Owner has put on a new roof and renovated 2 of the 4 units but did not have enough money to finish the project. NWPL funded the remainder of the rehab and 1-year of interest to complete the project. The new rental price is $1,000 per unit and the borrower can refinance the property conventionally.

Google Review: “Eric and his staff at NW private lending are awesome! When you are in need of fast funding on a real estate project make sure you call Eric! Absolutely the quickest and smoothest loan process there is!! Thank you Eric!” – gwsurf

Location: 1500 SW 5th Ave # 701, Portland, OR

Property Value: $400,000

Loan Amount: $250,000

Scenario: Client owns 2 condo units in the building free and clear which they rent out. They wanted to renovate one of the units but could not qualify for a loan without the rental income. NWPL funded 100% of the rehab + 1-year of interest payments to enable them to complete the project and refinance conventionally once rented out.

Google Review: “The people you didn’t know you needed in your life! Northwest Private Lending has put the personal connection back into lending… It has been years (I mean waaaay back- before mobile banking) since I felt I knew who I was working with – and felt that they knew me – when it came to banking/lending/investing. Not only did Lizz and Eric take the time (and I needed a lot of time!) to explain all the details and process to me, they did it in such a way that I actually felt as though they had my best interests at heart. If Northwest Private Lending offered traditional banking in addition to loans, I would be moving my accounts there today. Relationship-based lending- what a concept!!”

Location: 20501 E Lolo Pass Rd, Rhododendron OR 97049

Purchase Price: $261,000

Loan Amount: $350,000

Total Rehab Costs: $60,000

Income: $5,000 to 10,000 per month / Average $90,000 per year

Scenario: Borrower purchased this property back from the bank for $261K. It had previously been a vacation rental that rented for $500 per night. During the foreclosure the house and property fell into serious disrepair. Borrower will fix up, keep, and rent out the property. https://youtu.be/lqNwh_OHV_Y

Customer Review (Google): Rick Lycksell – “I have been using hard money lenders for over 20 years. Working with Eric is the best he is there to help however he can. They give 100% attention when doing the deal maki g sure it goes seamless and very quick. If your looking to rehab, flip of what ever this is the company I recommend you use.Rick L”

Location: 7430-7434 NE Fremont St, Portland, OR

Purchase Price: $310,000

Loan Amount: $248,000

Total Rehab Costs: $75,000

Current Value: $500,000

Income: $5,500 per month / $66,000 per year

Scenario (Distressed Seller): Property is a mixed-use commercial / residential building. Our client used our loan to make a cash offer and get the property at a discount. They have fixed up the property and signed 2 new commercial tenants who helped pay for the improvements. When refinanced, the residential tenant’s rent alone will pay for the conventional rate mortgage, leaving the commercial spaces as pure profit.

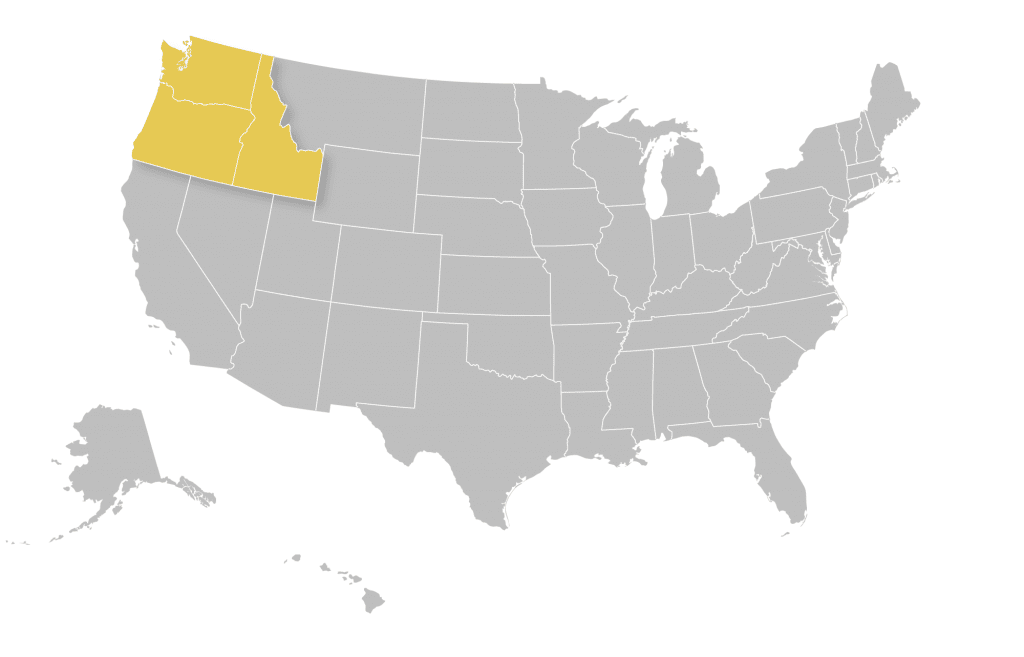

We currently service loans in Oregon, Washington, and Idaho.