5335 Meadows Rd, Suite 388

Lake Oswego, OR 97035

When it comes to fixing and flipping real estate in today’s housing market, cash and speed are essential. At Northwest Private Lending, we provide hard money loans which act like cash so that our clients can make competitive offers on properties they’d otherwise miss out on. Our fix and flip hard money loans provide up to 80% of the purchase price, which leaves our clients with the cash they need to renovate the property themselves. We never charge prepayment penalties, allowing you to sell the property as quickly as possible. We also do not charge extension fees, so if your project takes longer than expected you can have confidence that you can keep your loan with us as long as you need it.

Loan Origination Fee: 3 Points (min. $2,500)

Loan Document Fee: $650-850

Monthly Interest Rate: 1% per month

Monthly Payment: Interest Only

Loan Amount Range: $50,000 up to $2,000,000

Closing Costs: Paid by Borrower

Loan Closing: 3-5 Business Days

Loan Maturity: 1 month to 10 years

Property Appraisal: Not Required

Underwriting Fee: None

Pre-Payment Penalty: Never

Extension Fee: $0 on performing loans

At Northwest Private Lending, we love getting to work with first-time real estate investors like Justin! By taking advantage of a hard money bridge loan, Justin was able to turn a fix and flip property into a wealth-generating asset that opened the door to many other successful real estate investments in Portland.

Location: 3759 N Melrose Dr, Portland, OR

Purchase Price: $483,000

Loan Amount: $400,000

Total Rehab Costs: $300,000

Listed For: $1,250,000

Scenario (Distressed Seller): Property was gutted and could only be purchased with cash or Hard Money; Amazing neighborhood and views; Needed full renovation and 18 months to complete; Buyer is a builder and will make over $400K in profit when completed.

Location: 102 NE Grace Ave, Battle Ground, WA

Purchase Price: $160,00

Loan Amount: $130,00

Total Rehab Costs: $80,00

Listed For: $399,000

Scenario (Distressed Seller): Property had foundation issues and could only be purchased with cash or Hard Money; Buyer is a contractor that specializes in foundation repair and was able to fix issues inexpensively and renovated the property. The Flip will make almost $190K in profit.

Location: 118 Bodine Rd, Kelso, WA 98626

Purchase Price: $185,00

Loan Amount: $135,555

Total Rehab Costs: $70,00

Listed For: $358,000

Scenario: Borrower is a pharmacist who tries to flip 1 house per year for extra income. This home was going into foreclosure and was purchased as a short sale with the bank which required cash or hard money. Borrower was able to renovate and sell for over $100K in profit.

Location: 1805 NE Dolphin Ln Waldport, OR

Purchase Price: $155,000

Loan Amount: $100,000

Total Rehab Costs: $40,000

Listed For: $249,000

Scenario: Property was in disrepair and could not qualify for a conventional loan. The Investor was able to purchase this waterfront property for a huge discount and fixed the few issues keeping it from conventional financing. They were able to get it fixed and sold in 3-months and made a quick $55,000.

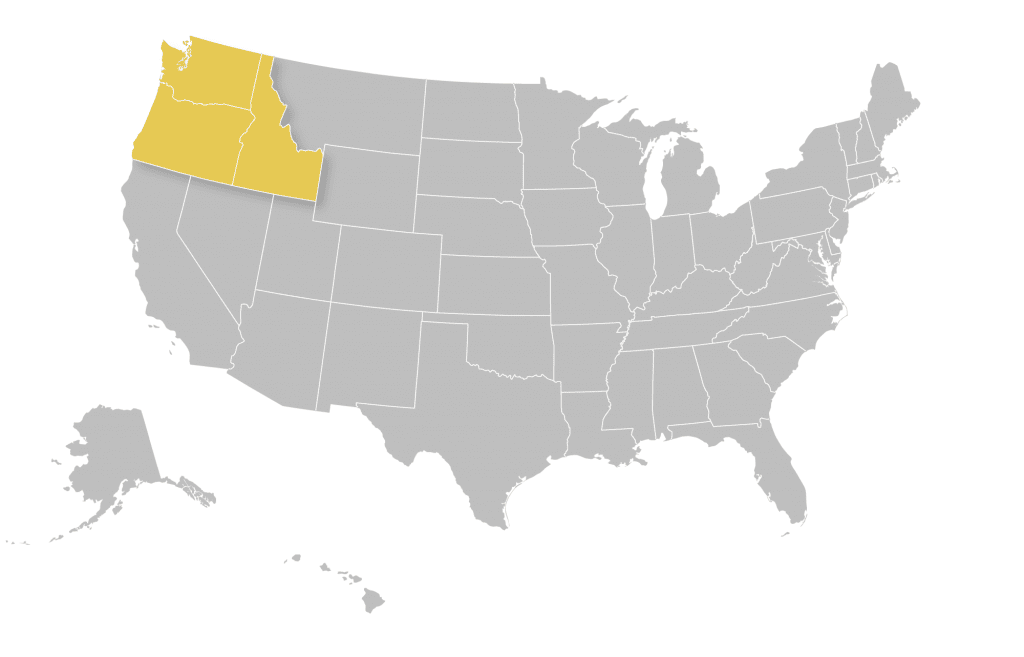

We currently service loans in Oregon, Washington, and Idaho.