5335 Meadows Rd, Suite 388

Lake Oswego, OR 97035

The transition from one property to another is easy if you have the ability to sell, get the cash and then purchase. But where will you live in the meantime? What if the house you are selling doesn’t close on time? Wouldn’t it be easier if you purchased first and sold second? Yes it would, but most lenders cannot support your new loan until you have received the proceeds from your sale. NW Private Lending’s bridge loan is able to use the equity in an existing property you want to keep or plan to sell towards your next purchase. We commonly can fund 100% or more of the purchase price of the new home, so you have the time you need to move, fix up the old house, then sell. Once you sell, the loan automatically pays-off or pays down the loan on your new home. Whether it is a primary residence or another investment property we want you to know you have options.

Loan Origination Fee: 3 Points (min. $2,500)

Loan Document Fee: $650-850

Monthly Interest Rate: 1% per month

Monthly Payment: Interest Only

Loan Amount Range: $50,000 up to $2,000,000

Closing Costs: Paid by Borrower

Loan Closing: 3-5 Business Days

Loan Maturity: 1 month to 10 years

Property Appraisal: Not Required

Underwriting Fee: None

Pre-Payment Penalty: Never

Extension Fee: $0 on performing loans

A hard money loan is a loan that is primarily secured by the equity in one or several pieces of real estate. A Hard Money loan is perfect to help people bridge between two properties since private lenders can use the equity in one home as the down payment for a new purchase.

Owned Property: 15052 SW Highway 126, Powell Butte, OR

Purchased Property: 212 S Miller St, Wenatchee, WA

Value of both properties: $700,000

Loan Amount: $350,000

Scenario: Our client found a great investment property that they wanted to purchase, but did not have their property ready to sell. Within 1 week, NWPL was able to lend 100% of the purchase price of the new property using the equity in the existing home. The client was able to sell their Oregon property in 3-months and paid off the loan from the proceeds of that sale.

BBB Review: “It was great working with Eric Larson and his Team at Northwest Private Lending. We needed funds to close a great deal in 5 days and they stepped up with just a phone call and explaining the deal and the property involved. At the end of the first phone call, we had a ‘Let’s make this Deal Happen’. A few more calls on details and did I mention two of the days were a weekend and we were signing paperwork and closing a great deal. We have used a lot of Private Money over the years but I would have to say this was quick and the Team at Northwest Private Lending was wonderful to work with. We look forward to using them in the future.” – Runnels

Owned Property: 34250 NE Colorado Lake Dr, Corvallis, OR

Purchased Property: 16394 Kitty Hawk Ave, Oregon City, OR

Value of both properties: $1,500,000

Loan Amount: $725,000

Scenario: Borrower owned a rental property in Corvallis and was buying a new construction home they had built. When it came time to purchase the home from the builder, the conventional lender was not able to meet the closing timeframe and the client was going to lose the home. NWPL was able to come it at the 11th hour and funded 100% of the purchase price by utilizing the equity in the existing home.

Owned Property: 7401 SW Kent Lane, Culver, OR

Purchased Property: 65725 Gerking Market Rd, Bend, OR

Value of both properties:

Loan Amount: $900,000

Scenario: Buyer was able to purchase a property out of bank foreclosure but needed cash or a hard money loan. NWPL was able to utilize the equity in one of their other investment properties to fund 100% of the purchase, cover all the closing costs and 4-months of interest. With a little breathing room, the client was easily able to refinance the property conventionally and paid off the loan before ever having to make a payment.

Customer Review: “I had an awesome experience with Erick and Northwest Private Lending! We were able to close our loan with great terms very quickly. His personal touch, attention to detail, and swift action make this a super win for us all! Thanks so much, Erick, I look forward to working with you on future deals!” – Jason Younkin

Owned Property: 2007 Conestoga Ln, West Linn, OR

Purchased Property: 2009 Conestoga Ln, West Linn, OR

Value of both properties: $1.2M

Loan Amount: $650,000

Scenario: Borrower has lived on the street for years. When their neighbor unexpectedly had to move out of state for another job they were able to buy the home before it came on the market. While they were getting the property at a discount they couldn’t wait for a conventional loan. NWPL quickly loaned all the money to purchase the new home by using the equity in their existing home. NWPL also funded 1-year of interest and the funds they needed so they could fix up and sell at a profit.

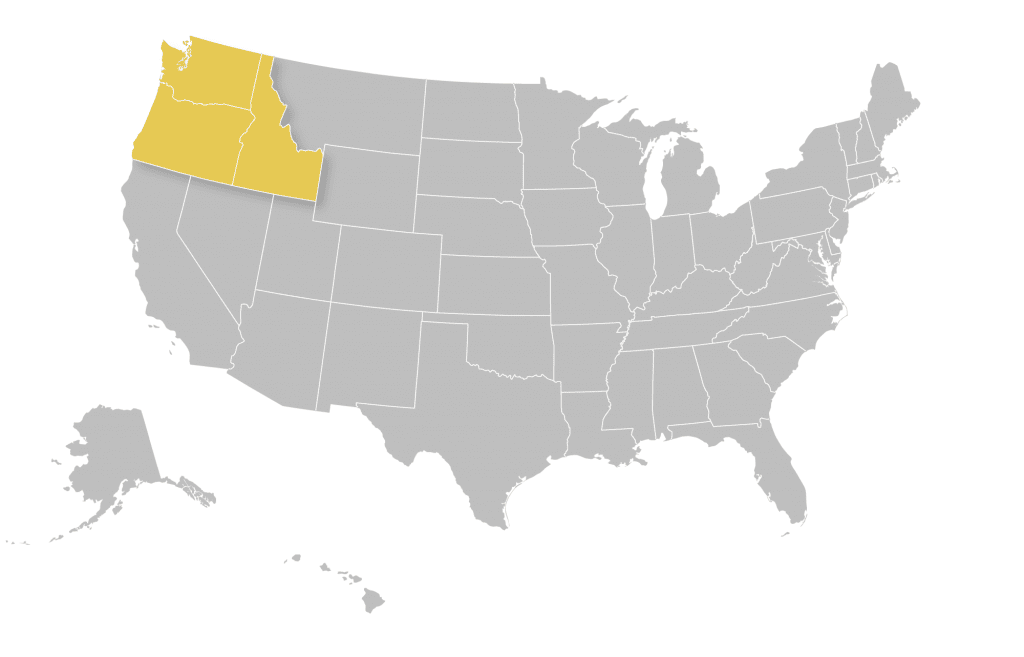

We currently service loans in Oregon, Washington, and Idaho.