5335 Meadows Rd, Suite 388

Lake Oswego, OR 97035

Real Estate like many assets gives the owner the opportunity to gain value over time. That increased equity in the property grows tax-deferred until the property is sold. A 1031 exchange is a tax advantage given to investors who sell an investment property and use the funds to purchase another investment property of equal or greater value. A reverse 1031 exchange is when you purchase the investment property before you sell the existing investment property you already own.

Loan Origination Fee: 3 Points (min. $2,500)

Loan Document Fee: $650-850

Monthly Interest Rate: 1% per month

Monthly Payment: Interest Only

Loan Amount Range: $50,000 up to $2,000,000

Closing Costs: Paid by Borrower

Loan Closing: 3-5 Business Days

Loan Maturity: 1 month to 10 years

Property Appraisal: Not Required

Underwriting Fee: None

Pre-Payment Penalty: Never

Extension Fee: $0 on performing loans

1031 Exchange – (Sell then Buy) When a client sells an investment property and takes 100% of the proceeds to invest in another investment property. I done correctly the profit from the sale can be rolled into the new investment tax-free.

Reverse 1031 Exchange – (Buy then Sell) When a client first purchases a property they wish to hold as an investment then sells another investment property and uses the profits to pay for that property. When done correctly this can also be done tax-free.

Loan Type: 1031 Exchange

Sold Property: California beachfront property

Purchased Property: 124 Duane St, Astoria, OR

Loan Amount: $150,000

Value after Renovataion: $375,000

Scenario: This was a 1031 exchange plus a fix and hold purchase. The client was using 1031 money from a sale in California to purchase the property in Astoria. They needed $150K to renovate the property. NWPL supported the 1031 exchange and funded the full renovation. Once completed, the borrower refinanced the property with a conventional loan and keeps it as a vacation rental.

Customer Review (Google): “I am a property manager and investor. NWPL is the BEST lender I have ever worked with over the last 19 years. They are always gracious, consistently work with us to achieve our goals, are efficient and Quick! in processing our paperwork and payments and very responsive. I can’t think of any negatives at all. I highly recommend them to any prospective client. Thank you NWPL!”

Sold Property: Previous flip property

Purchased Property: 2925 Field Street, Longview, WA

Value of both properties: 500,000

Loan Amount: $130,000

Scenario: This is one of our regular clients who does a lot of fix and flip properties in the area. They take the profits from the sale of a flip and 1031 them into the next property. Once they have enough profit to buy with their own cash, they keep it as a long-term rental and start the process over again. When we met, they owned 0 investment properties and now own 6 free-and-clear properties.

Customer Review (Google): “Truly one of the most ethical businesses I’ve ever worked with. They go above and beyond to help find solutions to difficult lending situations and the customer service exceeds anything I would have ever imagined. Wish I could give them ’10 Stars’. We are on our third transaction with them and will only use them for all of our investments from here on out.” – Christine Harper

Purchased Property: 58089 Tournament Ln, Bend, OR 97707

Purchase Price: $850,000

Loan Amount: $450,000

Scenario: Our client found the perfect investment property but needed to purchase it before they could sell their other investment property. The property they were selling had increased several hundred thousand in value and they wanted to take advantage of the 1030 exchange. NWPL was able to work with their 1031 exchange agent and enabled the loan and purchase of the new property prior to selling. Once their other property was sold, the proceeds paid off the NWPL loan and saved the client over $100K in taxes.

Customer Review (Google): “Best experience for a complicated financial transaction- professional, responsive and excellent customer service from start to finish. Eric and his team are exceptional.” – Krista Johnson

Reverse 1031 Exchange

Sold Property: 1539 PINE ST, SILVERTON, OR

Purchased Property: 5114 Eastview Ln Silverton OR

Value of both properties: 750,000

Scenario: This multi-step reverse 1031 exchange required the equity in the existing rental to purchase the new property. The existing propert was to be sold in the future and he funds would not fully pay-off the loan used to purchase the new property. Property 1 (to be purchased): Is under contract for $450,000. Property 2 (currently owned by borrower) will be listed for $225,000. The remaining loan with NWPL was refinanced with a conventional loan and saved the client $80K in taxes.

Customer Review – Scott Guenther: “This was the first time we had ever even considered using hard money and knew no one, so we called several names our realtor gave us. Eric was our third call but the first who seemed genuinely interested in our plan and how he could help make it work. Not a particularly easy transaction as we had found the perfect replacement property before we had even listed the property we were relinquishing in a 1031 exchange. Eric and Michelle worked with everyone involved in the purchase, reverse exchange, and eventual sale to make things go smoothly for us. He was extremely helpful, made the decision quickly on whether or not to move forward with the loan, and completed the transaction quickly so we could acquire this great property. I would most highly recommend him to anyone looking for this type of financing.”

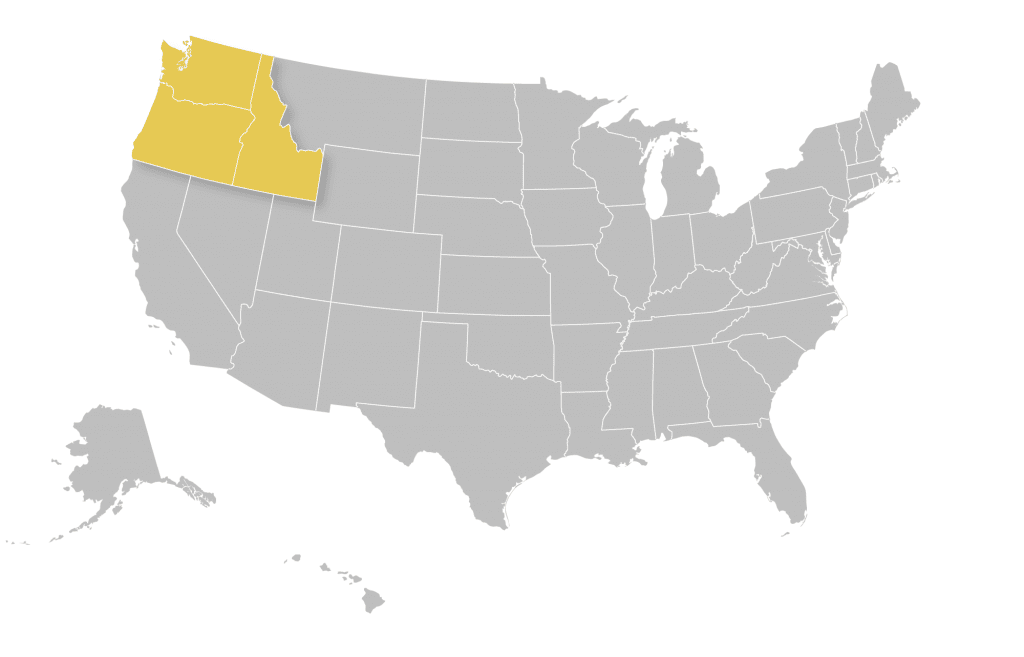

We currently service loans in Oregon, Washington, and Idaho.